Introducing AMD: How 1 Woman Saved a Giant

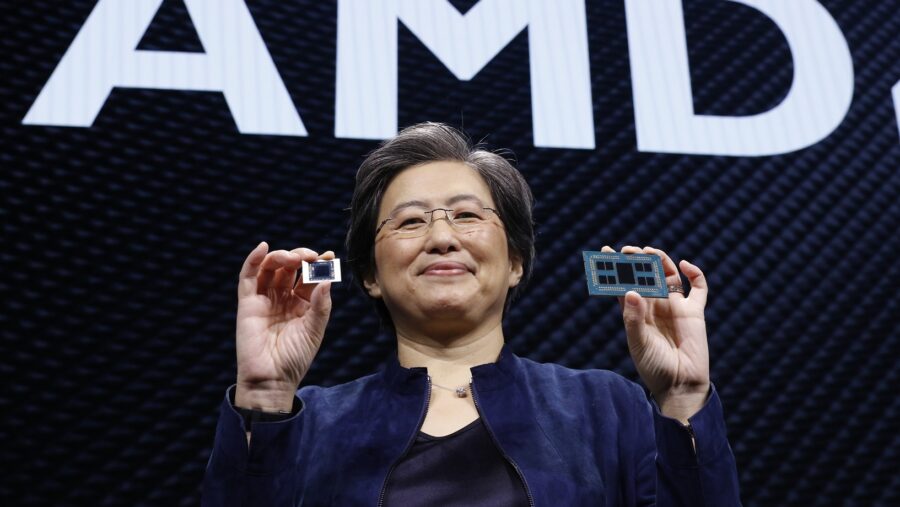

The CEO of Advanced Micro Devices (AMD) has engineered one of the biggest turnarounds in Silicon Valley history, boosting the share price of the ailing semiconductor maker more than 30 times in less than 10 years. It is now gearing up for the battle in artificial intelligence (AI) as part of the coming revolution.

Today, AMD is a well-known and respected company. In fact, it is the third most valuable chip maker and is also among the 50 most valuable companies in the world. With a market value of around USD 200 billion, it is even ahead of companies such as Toyota, Intel, Netflix and Walt Disney. Today, AMD develops and designs a wide range of chips for various promising industries such as cloud, supercomputing, 5G, artificial intelligence (AI), intelligent systems, gaming, simulation, visualization, and the Internet of Things (IoT). The company’s key products are the high-performance computing chips AMD Ryzen and Epic, the graphics chips AMD Radeon and Instinct, and the adaptive performance-oriented AMD Virtex, Zynq, Versal, and Kintex.

In practice, you’ll often find AMD chips in laptops, PCs, PlayStation or Xbox gaming consoles, or in data centers where information is stored in the cloud. As AMD’s business has blossomed in recent years, the company’s revenues and profits, and ultimately its stock, have grown rapidly. However, things haven’t always been so rosy for AMD. On the contrary, in 2014, the US chipmaker was on the verge of collapse. Before Lisa Su took the helm at AMD, the company was facing major problems that began at the turn of the 21st century. The company was losing market share, and after the financial crisis in 2009, it had to separate its manufacturing plant from chip development. In 2013, it was even forced to sell and subsequently lease its corporate premises in Texas.

At the time, Intel was dominating the laptop market, Qualcomm and Samsung were splitting the new smartphone business and Nvidia was winning the graphics card business. AMD was considered a perennial second-tier player. The situation had reached the point where the company had to lay off a quarter of its staff and some of its valuable assets were already being sold for parts. Losses were piling up, revenues were stagnant or falling. Analysts were calling the company uninvestable, and its stock plunged to around $2. The turnaround came in 2014, when Lisa Su (hereafter Lisa) took over as AMD’s CEO. She combines technical genius with people skills and business acumen, which she has taken full advantage of in her quest for success.

Shortly after its arrival, AMD’s share of the server chip market dropped to 0.5%, whereas before it was almost a majority. Lisa decided to favour a new chip architecture called Zen over the development of “old technologies”. The move paid off when it was launched in 2017. Zen had 50% faster computing power than the company’s previous products, which was a big improvement and also a signal to the rest of the market and customers. However, it wasn’t just about development. Lisa spent the early years building relationships, even though AMD had no chips to sell. She became famous for a story where she spent 4 hours driving a car in the middle of a snowstorm to charm the CEO of Hewlett Packard.

Under new leadership, with more powerful products and a better vision, the company was waiting for its opportunity. It came after the mistakes of a rival. Intel delayed production, Apple chose not to use its chips in its phones, and it lagged in development. Lisa took advantage of the situation and struck deals with electronics makers Lenovo and Sony. Important deals with Google and Amazon, which are spending billions of dollars on data centres, have also joined in.

How is AMD doing at the moment?

AMD is back in the limelight today. Since Lisa joined in 2014, the company has managed to quadruple revenue between 2015 and 2022 to $23.6 billion. The business has also managed to dig itself out of losses and has been highly profitable in recent years.

The uninvestable company has become Wall Street’s new darling in just a few years, and the stock has gradually risen from the $2 level in 2015 to nearly $130. That represents a 65-fold increase. Intel’s annual revenue of $63 billion as well as profits continue to exceed AMD’s numbers. However, under Lisa’s leadership, AMD is rapidly gaining market share at the expense of its competitor, particularly in data center chips, which is currently the fastest-growing segment of the consumer sector.

The graphics card business is now dominated by Nvidia, which controls 84% of the market. AMD’s share is around 12% and rising, while Intel is in last place with 4%. These figures refer only to stand-alone GPU and add-on graphics card shipments, excluding integrated and embedded graphics. If integrated and embedded graphics are included, Intel has 71% of the market, Nvidia 17% and AMD 12%. According to a report by Mercury Research, AMD also managed to increase its share in CPU shipments from 28,5 % to 31,3 %, while Intel’s share fell from 71,5 % to 68,7 %.

Lisa has done the near impossible in the tech world, overtaking Intel, and now has another audacious goal in front of her. To dethrone Nvidia. The latter is in a much better position, unlike Intel, whose revenues have fallen 12% in three years to $63.1 billion. Indeed, Nvidia fearlessly leads the supply of chips that underpin generative artificial intelligence. In the current ‘boom’ around AI, this is a very lucrative market with huge potential. Investors are fully aware of this, which is why Nvidia’s stock price has catapulted to new heights, and the company has surpassed the trillion-dollar mark as the 8th company in history. However, AMD will be looking to snatch a piece of the big pie for itself. Under Lisa’s leadership, research and development spending has nearly quadrupled to $5 billion, virtually as much as the company generated in revenue when she took over.

AMD is also fighting Nvidia with acquisitions. Last year, it bought Xilinx, which makes programmable processors that speed up operations, for $48.8 billion. Also worth noting is AMD’s $1.9 billion acquisition of Pensando, which will strengthen AMD’s data centre offerings.

Source, photo: portu.cu

Author of this article

WAS THIS ARTICLE HELPFUL?

Support us to keep up the good work and to provide you even better content. Your donations will be used to help students get access to quality content for free and pay our contributors’ salaries, who work hard to create this website content! Thank you for all your support!

OR CONTINUE READING