China has a huge lead in electric cars and the cars cost and sell it for third of what they cost in Europe

China has massively subsidised EVs for 13 years and transformed the entire industry. It holds global dominance over the supply chain. What will be Europe’s attitude towards Chinese cars?

In 2022, 10.5 million battery cars (including hybrids) will be sold globally, including 6.2 million in China, where one in four cars sold is battery-powered. In absolute numbers, China beats both Europe and the US, although 2022 was also a record year for Europe. The success of China’s EVs is due to consistent government policy, but also to a technological edge.

22 years of effort

China has historically been an important region for traditional Western automakers, which have played a dominant role in the market there. Local manufacturers have been unable to catch up with the technological lead and have struggled with, among other things, Chinese skepticism of locally produced cars. It was also because of this dependence on the West that the Communist Chinese government decided to change this in 2001, when it planned the first incentives for associated industrial and economic areas in the tenth five-year plan.

The main accelerator was Wan Gang, who, among other things, had worked at Audi since 1991 and was involved in the success of the first Audi A4. As part of the 863 Programme, he produced a key document that convinced the then Party leadership of the economic opportunity of electric mobility. He identified it as a new stage in the Chinese automotive industry, and above all a chance to significantly reduce the market share of foreign manufacturers in China. In 2007, he became Minister of Science and Technology and was given a virtually unlimited budget for his electromobility plan.

13 years of subsidies

Since 2009, the Chinese government has launched massive incentives for EV manufacturers and buyers. While it has offered significant tax breaks to carmakers, it has handed out generous subsidies to the Chinese. In the first few years, it was possible to receive up to 100,000 yuan (more than $14,100) to buy a car. The system was governed by a simple table which determined the amount of the subsidy according to the range of the car purchased.

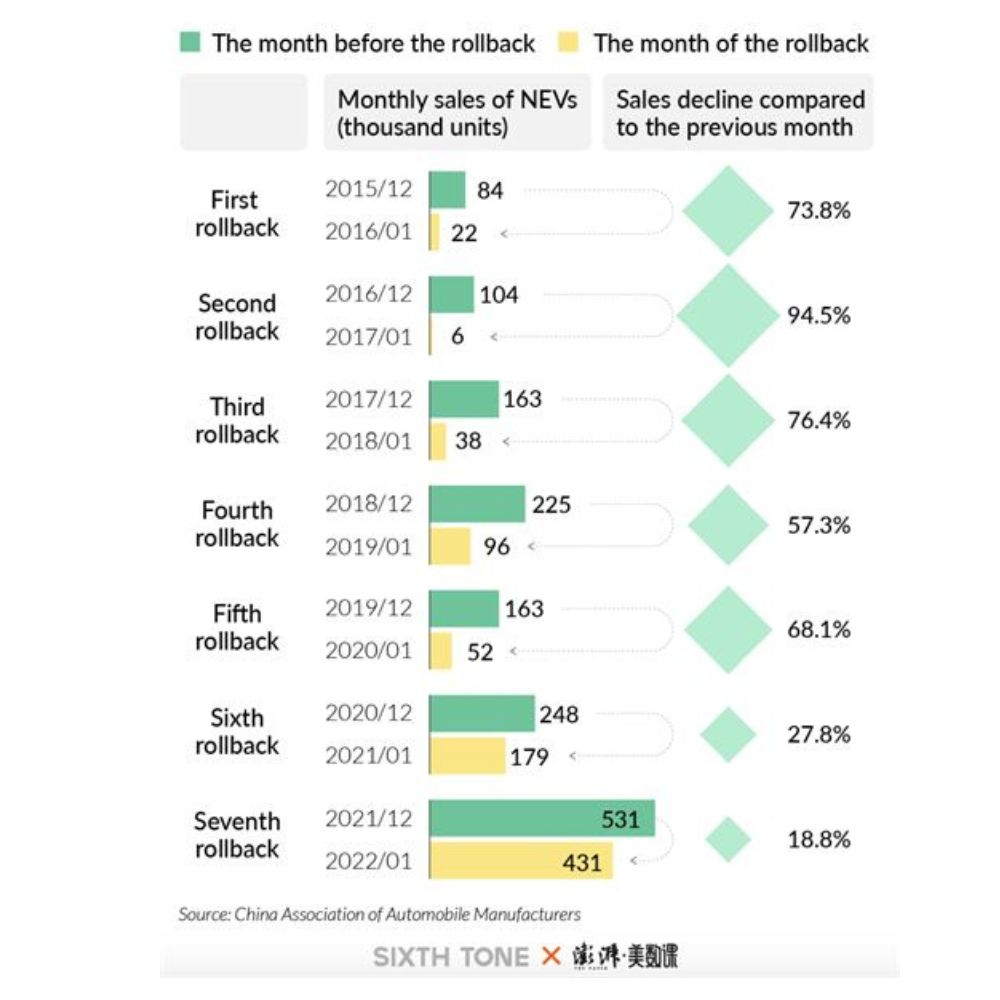

Over thirteen years, the Chinese government invested 152 billion yuan in this way (approximately $21,983,743,280). At first, the generous subsidies were gradually reduced, but they were still tempting sums that encouraged end users to switch to electromobility. Although the gradual reduction in subsidies also meant a significant drop in sales in the first years, each further reduction in subsidies brought smaller fluctuations in sales.

Gradual reduction of subsidies and impact on overall EV sales. The changes have always occurred in December and in January sales dropped significantly. In recent years, however, the differences have narrowed

The programme ended on the last day of 2022, but by then the subsidies were minimal and only for higher-end models – so they accounted for only 5-10% of the purchase price. Thus, the abandonment of this program had virtually no effect on actual sales and today there are no subsidies for end buyers.

A lingering benefit is the tax forgiveness on battery car purchases, which is in place until the end of 2023. At the same time, the government has also ended major concessions to automakers, which may mean a partial consolidation of the extreme number of Chinese automakers, some of which were able to exist primarily due to support programs.

At the carmaker level, the government introduced a dual-credit system two years ago, with battery makers collecting positive credit and internal combustion car makers collecting negative credit. In order to operate in the market, they have to erase the negative credit by buying the positive one from competing manufacturers. Automakers are thus incentivised to include EVs in their portfolio to take care of the credit balance. Otherwise, the negative credit will increase the cost of the internal combustion car and therefore the final price.

Public transport and free registration

Chinese car companies did not grow in the noughties only thanks to tax breaks. The government invested in the electrification of public transport, and large tenders were issued not only for buses or minibuses, but also for public taxis. Significant capital was also attracted to companies in this way.

On the end-user side, there were additional benefits. In congested conurbations, waiting for a registration plate, which in Beijing, for example, can take up to a year and cost several thousand dollars, has been eliminated. But new EV owners avoid both the rationing system and the payment for the plate.

Technological superiority

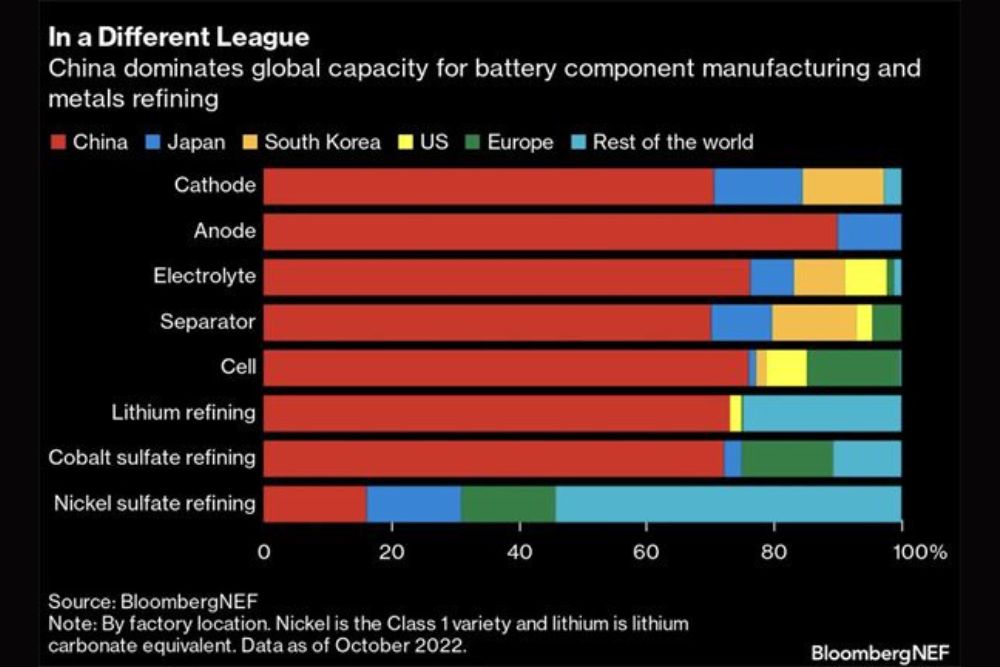

For American and European carmakers, car technology is not the problem, nor is increasingly complex software. All of the traditional car concerns and alliances have developed their own platforms on which to build EVs in several price categories. But if there’s one place where they are a steamer behind the Chinese carmakers, it’s batteries. These often account for up to 40% of the total cost of a new car, and if a manufacturer cannot produce them cheaply and in large quantities, competitiveness suffers greatly.

Chinese manufacturers now routinely rely on LiFePo4 batteries, which they produce at a much lower cost. At the same time, they have succeeded in eliminating the primary disadvantage compared to Li-Ion cells, which are still used by the majority of European cars – low energy density. They produce batteries with a capacity of over 100 kWh for their cars, which can provide a range of many hundreds of kilometres for even the heaviest SUVs. The advantage of LiFePo4 is primarily the absence of nickel and cobalt, but also other operating characteristics. The batteries are more resistant to temperature fluctuations and will not burn if damaged.

But most importantly, China underpins the complete global battery industry. As the chart below shows, virtually all links in the battery production chain are dependent on China. Although many car companies are already building or planning to build new battery factories in European countries, they will lag behind the Chinese ones not only in capacity but above all in cost. And not only for the production of current batteries, but also for the development of future ones.

Last month, the Chinese battery giant CATL began mass production of a new generation of CTP 3.0 (cell-to-pack) batteries with an energy density of 255 Wh/kg. The commonly used Li-Ion and LiFePo4 batteries have a density of around 150-160 Wh/kg. Although CTP 3.0 is not a revolutionary technology, it will quickly find its way into mass-produced cars. The potential for price reductions in all categories is considerable.

The European dilemma

Chinese car companies can produce a usable five-door electric car for under $14,100, and the mid-range is spread over a wide range well below a million kronor. Unlike European and American cars, which start at a million.

Predictions are even more optimistic – Leapmotor’s CEO, Zhu Jiangming, said at a recent Shanghai auto show that it will be possible to buy an SUV with a range of 400 km for $7,500 in China later this decade. Neither European nor American automakers will have an answer to this development.

Author of this article

WAS THIS ARTICLE HELPFUL?

Support us to keep up the good work and to provide you even better content. Your donations will be used to help students get access to quality content for free and pay our contributors’ salaries, who work hard to create this website content! Thank you for all your support!

OR CONTINUE READING